Auto

Alfa2Go

GET - In Google Play

Uninsured/underinsured motorist (UM) coverage helps protect you if you’re in an accident with someone who either doesn’t have insurance or doesn’t have enough to cover the damage.

*Only applies if uninsured/underinsured motorist is at fault and your policy has uninsured/underinsured motorist coverage.

All coverages are subject to deductibles and policy limits. This is not an insurance policy. It is intended only to provide a general description of Alfa Insurance® and/or its product lines and services. An actual policy contains the specific details of the coverages, conditions and exclusions. Your Alfa® agent can explain the policy and benefits and answer any questions you may have before you buy.

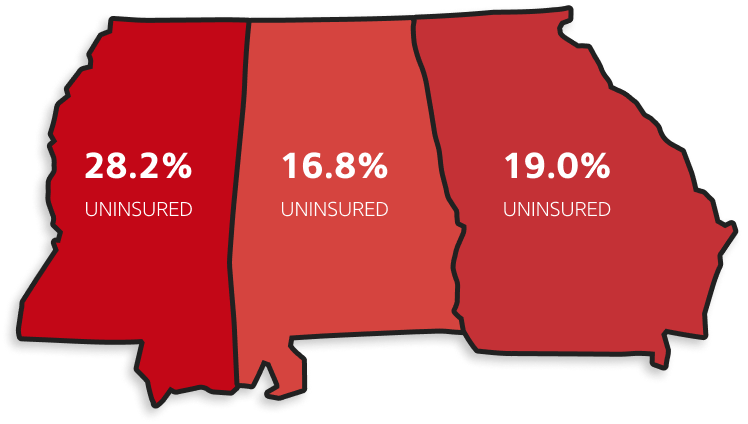

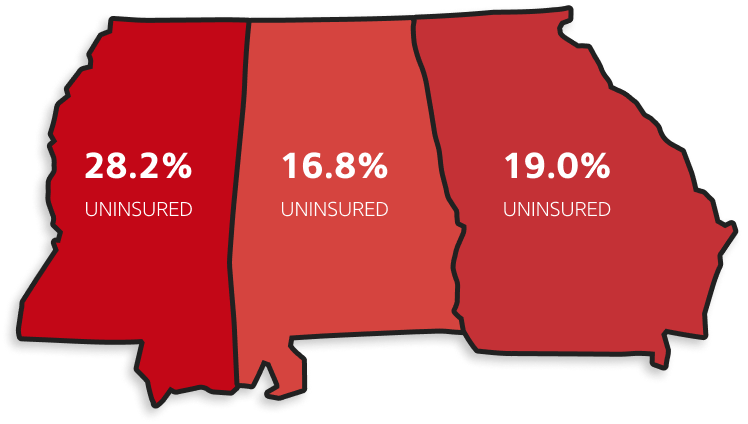

According to a 2025 study by the Insurance Research Council

According to a 2025 study by the Insurance Research Council

Auto

Auto