When Is the Best Time to Get Life Insurance?

Did you know it’s best to get life insurance early in life? Life insurance rates are primarily based on your age and health, meaning the longer you wait, the higher your premiums could be. Applying for coverage when you’re younger and healthier not only makes your coverage more affordable but also increases your chances of approval.

The earlier you get Life Insurance, the better

The sooner you can secure coverage, the better it is for your loved ones and beneficiaries. Having life insurance at an early adult age means your family is less likely to experience financial strain in the event of your unexpected passing. Plus, it’s wise to go ahead and apply for coverage before any unexpected health conditions arise.

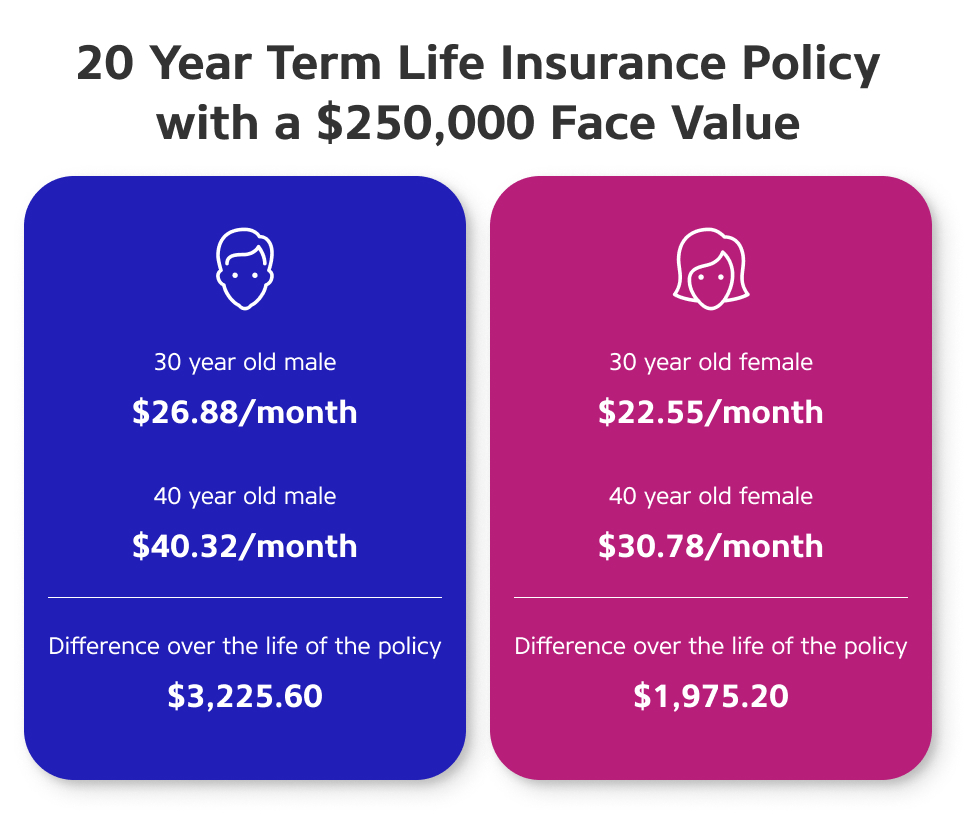

The chart below displays the average costs of an Alfa® 20-year term life insurance policy with a $250,000 face value for healthy, non-tobacco users.

Consider purchasing Life Insurance when...

You hit a major milestone

Life events such as graduating college, getting married, or having children are excellent opportunities to consider purchasing life insurance. Even if you haven’t started a family yet, life insurance is still a wise choice if you have someone who depends on you financially, like a sibling or elderly parent. It helps safeguard your loved ones from being burdened with your financial obligations, like personal loans or student debt.

You buy a home

If you’ve bought your first home or are building your dream home, it’s important to have life insurance. If you were no longer able to contribute financially for your family, life insurance can help cover your mortgage payments and prevent the loss of your home.

Your career changes

If your career or role has changed, it’s a great time to reassess your life insurance needs. An increase in your income or responsibilities can play a part in your lifestyle and may impact your long-term plans. Life insurance plays a vital role in replacing your income and covering financial commitments if you were to unexpectedly pass away. While employer-provided life insurance is a great benefit, personal coverage offers additional security, giving your loved ones the financial stability they need to maintain their lifestyle.

Your health changes

Addressing potential health risks is important when applying for life insurance, as some health conditions can make it more difficult to qualify for coverage. Changes in your health could lead to higher medical expenses or reduced earning potential, making it more important than ever to protect your dependents. Securing coverage after a health change can ensure your loved ones have the protection they need before further health complications arise.

|

The benefits of Life Insurance

Life insurance offers a wide range of benefits that provide financial security and peace of mind for you and your loved ones. Most life insurance coverages can be tailored to fit your specific needs and budget. It not only protects your beneficiaries but also helps cover outstanding debts, replaces your income, and can leave a lasting financial legacy for your family. Some permanent policies may build cash value over time, offering additional long-term advantages. Life insurance can also help cover funeral and burial costs, as well as any other end-of-life expenses, relieving your family of financial stress during an already challenging and emotional time.

Prepare for a better financial future today

If you have loved ones who rely on you financially, life insurance is crucial. Don’t wait for a major life event like parenthood to scare you into action—by then, it might be more challenging to secure coverage.

No matter what stage of life you’re in, there’s a life insurance option for you. Contact your local Alfa agent to explore life insurance coverages.

| Find an Agent Near You |

All coverages are subject to deductibles and policy limits. This is not an insurance policy. It is intended only to provide a general description of Alfa Insurance® and/or its product lines and services. An actual policy contains the specific details of the deductibles, coverages, conditions and exclusions. Your Alfa® agent can explain the policy and benefits and answer any questions you may have before you buy.