Alfa2Go

GET - In Google Play

Protect your assets and your future with an umbrella policy.

Coverage that goes beyond

Just as an insurance policy gives protection over you, an umbrella policy will protect you over and beyond the liability limits of your other policies.

Get a quote today!

Personal Umbrella

Give yourself some peace of mind for instances where the damages exceed the liability limits on your policy. A personal umbrella policy will cover the difference beyond your policy limits.

Farm Umbrella

No more worrying about surprise accidents on the farm. Save yourself the trouble and get extra protection for your farming needs that your standard policy can’t handle alone.

Commercial Umbrella

Protecting your business is our business. Lessen the risk with a commercial umbrella policy that will extend the limits beyond your standard policy.

Personal Umbrella

Give yourself some peace of mind for instances where the damages exceed the liability limits on your policy. A personal umbrella policy will cover the difference beyond your policy limits.

Farm Umbrella

No more worrying about surprise accidents on the farm. Save yourself the trouble and get extra protection for your farming needs that your standard policy can’t handle alone.

Commercial Umbrella

Protecting your business is our business. Lessen the risk with a commercial umbrella policy that will extend the limits beyond your standard policy.

What is umbrella insurance?

Umbrella insurance is an additional policy that provides excess liability limits after the limits of another policy are exhausted. Consider it the cherry on top to your insurance portfolio.

Who should get an umbrella policy?

The last thing you want is for your auto, home or watercraft liability limits not to be enough to cover property damages, legal costs or injury claims to a third party. Everyone can benefit from having an umbrella policy. People who own a swimming pool or trampoline, have a teenage driver or coach youth sports may consider umbrella insurance. The greater the risk, the more you have to lose.

Can you afford Personal Umbrella Insurance?

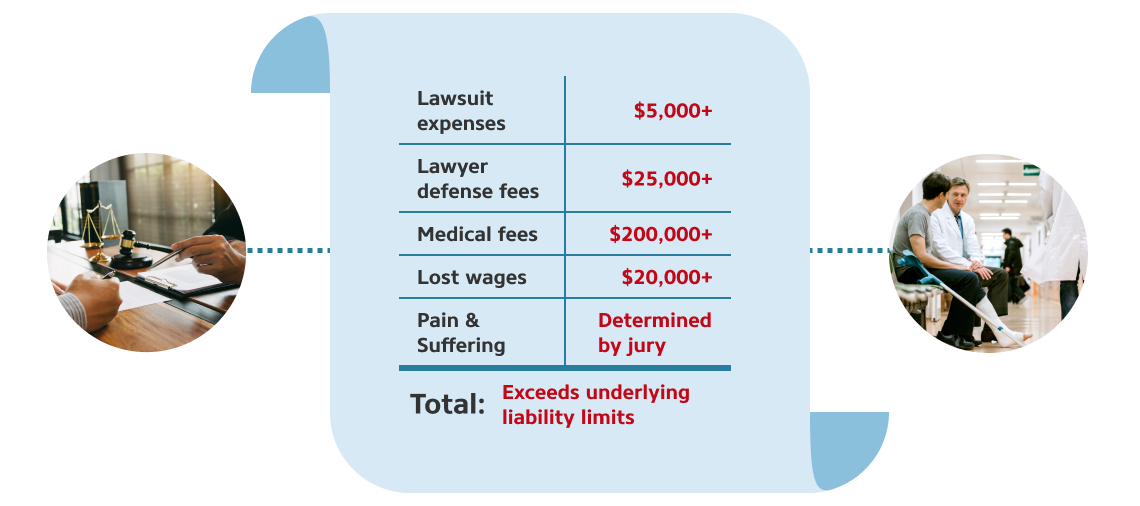

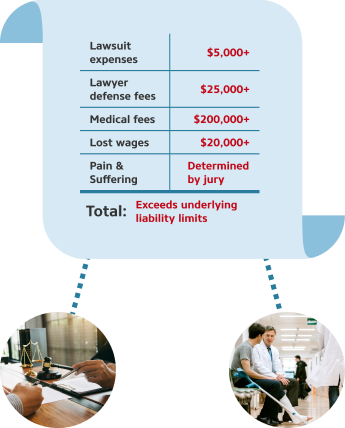

Insurance gives financial security that you hope you never have to use. Adding a policy may seem excessive, but liability claims can be expensive. Let’s consider this...

If you have a $300,000 liability limit on your auto insurance and cause a car accident, leaving someone seriously injured, you're looking at a major auto claim. With an umbrella policy, you can worry less about out-of-pocket expenses.

Can you afford NOT to have an umbrella policy?

This illustration is hypothetical. Actual coverage amounts will vary.

Ready to get a personalized quote?

Other

Other