Roof Factors That Can Affect Your Insurance

If you’ve ever talked with an insurance agent about homeowners insurance, you may wonder why they ask about your roof. Roof age, shape, condition, and material all play a part in determining your insurance rate and coverage. Whether you’re considering a roof replacement or getting insurance for the first time, understanding the following roof factors can help you make informed decisions about your coverage.

Roof factors that can affect your insurance

1. Roof shape

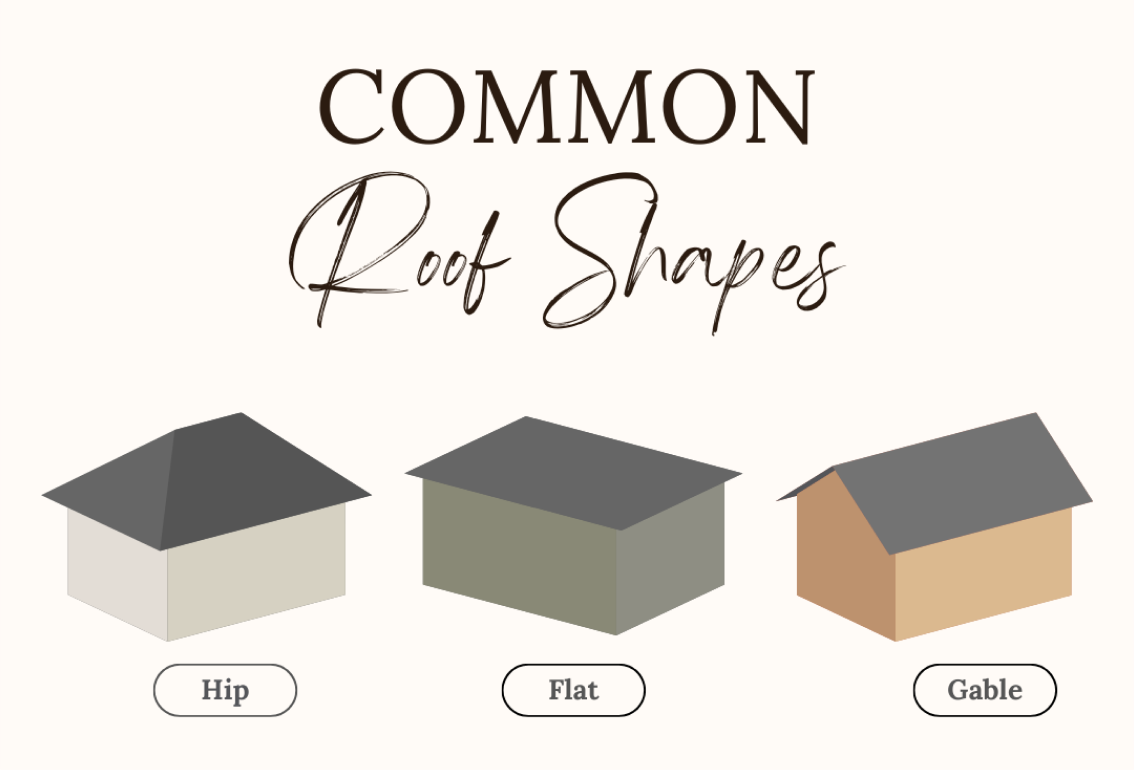

Roof design and shape can have an impact on your insurance simply because some shapes are more durable, complex, and costly than others. If the shape of your roof is more susceptible to damage, your insurance premium might be higher to account for potential repairs. Hip, flat, and gable roofs are three common roof shapes in the United States.

Hip Roof

Although this doesn’t mean you have the coolest roof on the block, you may have a lower premium. A hip roof shape is very common due to its ease of building and downward incline on all sides that helps with water runoff. This roof shape is durable against heavy wind and rainstorms and is known to have a stable structure.

Flat Roof

Contrary to its name, a flat roof isn’t completely flat. It has a slight slope on each side for water to drain off and is most common in commercial buildings. While a flat roof may be cheaper to build, you may be charged a higher insurance premium because of its increased likelihood of risk and water damage.

Gable Roof

A gable roof is arguably one of the most common roof shapes in today’s new builds. With two sloping sides that meet at a ridge to form a triangle, this roof type is easy to construct and maintain. It can provide more attic space than other shapes and is often affordable. While it doesn’t typically hold water and debris, it is known to be prone to wind damage.

2. Roof age

An older roof can have a higher risk of damage and is more likely to need replacement. Because of this risk, older roofs typically have higher insurance premiums. Keep this in mind when performing annual roof inspections and maintenance to increase the life of your roof.

3. Roof material

The material of your roof impacts your home’s insurability, as some materials last longer and offer greater durability. Deterioration tends to take place in some materials quicker than others: asphalt shingles in the southern states withstand more humidity and heat and are likely to need replacing sooner than other roof types. The quality and average lifespan of your roofing material are factors that also help determine your insurance premium and coverage.

Some common roof materials include:

Asphalt

Affordable, durable against most elements, and long-lasting, asphalt is the most common roof material across the southern part of the United States. The average lifespan of asphalt shingles is 15-25 years, but they may deteriorate faster in warm, humid locations.

Metal

A metal roof is the most durable and fire resistant of the roof types, making this a favorite for most insurance providers. Seamless and sleek, metal roofing materials can repel heat, sustain high winds, and typically last up to 40 years.

Slate or tile

Similar to metal, slate or tile roofs are low maintenance and are usually resistant against rotting, insects, debris, and fire. Slate and tile materials can be more expensive and may be prone to breaking upon impact.

Wood

Wood roofs are affordable and can add a nice curb appeal to your home, but they are more likely to experience rotting, water damage, and insect damage. Wood materials are hard to insure and not highly favored by insurers because they are not fireproof unless a fire retardant has been applied.

4. Roof condition

A well-maintained roof is likely going to last longer than a roof that has been neglected. Roofs with plant growth, missing shingles, water leaks, and other issues can be a recipe for disaster–for you and your insurance provider. Taking care of your roof and making timely repairs can increase its lifespan and lead to a lower and more consistent insurance premium.

Can you use home insurance to replace your roof?

Insurance typically only covers roof repairs or replacement if there is a covered loss like hail damage, wind damage, fire, etc.

If your roof is old and worn, it’s your responsibility to handle the cost of getting it replaced. Additionally, it’s your duty as a homeowner to take care of your roof, perform routine maintenance, and replace any decaying or damaged areas.

How do I know it’s time for a new roof?

Keeping records of your roof’s age and repair history can help you determine if it’s time for more repairs or a full replacement. It may be time to talk to your insurance company or a professional roofer about a new roof if:

-

Your roof is nearing the end of its lifespan

-

You notice a multitude of dark spots

-

Parts of your roof are sagging

-

You see bald spots where granules are missing

-

Shingle edges are starting to peel/curl up

Keep your insurance information up to date

Many first-time home buyers may think that insurance is a one-time deal: when you buy the home and get your insurance policy, that’s all and you’re good to go! However, insurance is an ongoing part of being a homeowner and you should update your agent with any changes you make to your home or property. Below are things you should notify your agent of as soon as possible so your coverage can be adjusted if needed:

-

If you get a new roof or repairs made

-

If you renovate any part of your home that adds square footage to your roof (deck, attached garage, etc.)

-

If you make changes to your home that add significant value

Your roof is important to the overall value of your home and can impact your insurance rate. Make sure you have the coverage you need by calling your local Alfa® agent️ and discussing your homeowners insurance needs today.

*This is not an insurance policy. It is intended only to provide a general description of Alfa Insurance® and/or its product lines and services. An actual policy contains the specific details of the deductibles, coverages, conditions and exclusions. Your Alfa® agent can explain the policy and benefits and answer any questions you may have before you buy.