Alfa2Go

GET - In Google Play

At an average of $1 per day, renters insurance is a low-cost way to protect your belongings and your personal liability.

A set of coverages designed to protect you from financial hardship due to a covered loss while you’re renting a residence.

Contact an Alfa Agent for a personalized quote

Coverage to repair or replace your items, such as electronics, bedding, furniture and more.

Coverage for additional living expenses, such as a hotel bill, if the place you’re renting is deemed unlivable due to a covered loss.

Injuries & Damages

Coverage for medical bills and/or legal fees should a guest become injured while visiting the place you rent.

Coverage to repair or replace your items, such as electronics, bedding, furniture and more.

Coverage for additional living expenses, such as a hotel bill, if the place you’re renting is deemed unlivable due to a covered loss.

Injuries & Damages

Coverage for medical bills and/or legal fees should a guest become injured while visiting the place you rent.

How much does renters insurance cost?

The price of your renters insurance premium will vary based on your individual needs and factors such as your location, deductibles and claims history; however, renters insurance is surprisingly affordable.

How much renters insurance do I need?

This depends on where you live and how much money you would need to replace all your belongings if they were destroyed. It’s smart to consider getting the highest personal liability limits you can afford.

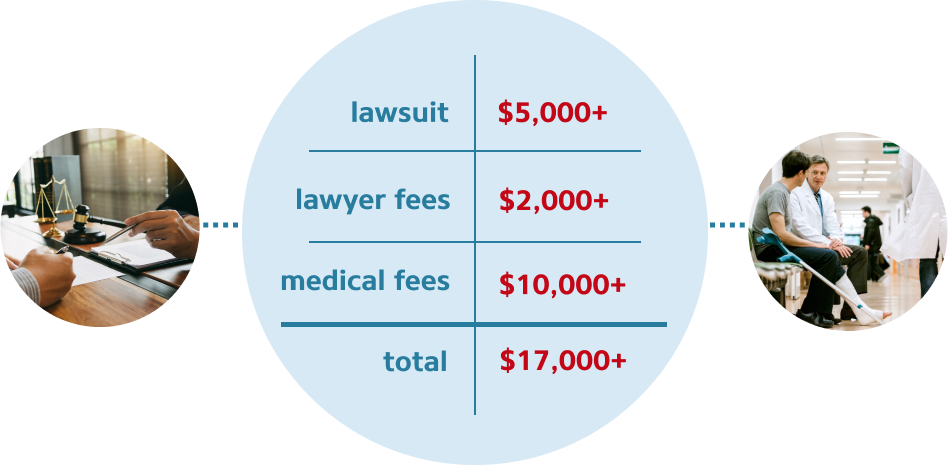

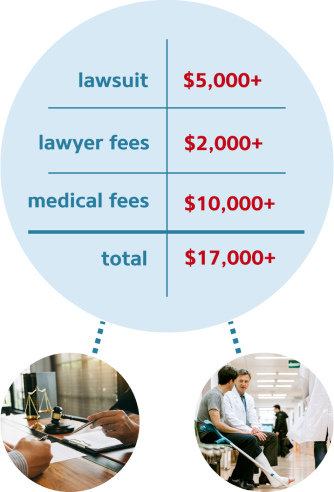

Can you afford renters insurance?

Having to replace all your belongings is expensive, but imagine how pricey it could be if you’re sued by a visitor for an injury you’re liable for. Could you afford to cover all these costs? Renters insurance is a low-cost coverage, so the real question is:

Can you afford not to have renters insurance?

Amounts shown only provide a general description of potential claims costs. Costs of each claim may vary greatly.

Ready to get a personalized quote?

Home